TURF Analysis

This article reviews how to use a TURF analysis to choose the right combination of products, features, or messages to appeal to the widest audience.

It can be tempting to try and give your customers every single product, feature, or service they ask for. But no matter how ambitious your brand is, the fact remains; you can’t do it all.

In fact, trying to fulfill every whim will only end up straining your time, capital, and energy. Instead, you have to strike a delicate balance of providing just enough variety without overextending your resources.

That’s exactly why many companies turn to TURF analysis to help them carefully choose the right combination of products, features, or messaging to maximize their reach.

Sound interesting?

Keep reading to learn how to you can use TURF analysis in your own consumer research to expand your appeal within your target market.

What is TURF Analysis?

TURF stands for Total Unduplicated Reach and Frequency.

It's a statistical methodology used in consumer research to find an optimal mix of offerings (like products, features, or message points) that appeal to the maximum number of people in the most efficient and cost-effective way.

If that sounds a bit complicated initially- don't worry. It’s actually quite simple! 😎

In survey research, TURF is used to analyze questions where respondents select options they prefer from a set. It uses that data to uncover the combination of options that has the highest unduplicated reach.

Unduplicated being the keyword.

Whether the options you’re testing are new products, features, or messaging- some options will likely appeal to similar audiences or even overlap with your existing offerings. The goal of TURF is to identify which options have the least overlap, so that the combination you select appeals to the largest number of people.

Why is TURF Analysis Useful?

If you’re still a bit unclear on TURF's practical use cases in consumer research- let's take a look at an example.

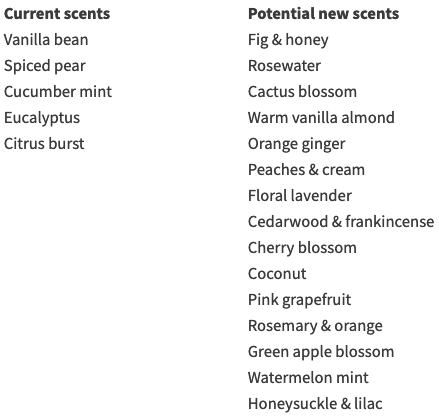

Say your company makes and sells hand soap. You currently have five high-selling scents, but you’re ready to expand your SKUs. So, your innovation team comes up with 15 new scents:

No matter how great all of the new scents are, you know you can’t develop them all.

Why? Because it would be incredibly time-consuming and cost-prohibitive to manufacture and ship each individual product. Not to mention the marketing and messaging lift.

Looking at the logistics, you can feasibly move forward with 3 new scents out of the 15.

So now, you’ve got to choose.

You could just pick your favorites- but that wouldn’t be all that helpful. Realistically, you need to select the scents that will help you expand your customer base.

So, you turn to research.

Running a survey with your target market, you include a multi-select question presenting respondents with all of your current and proposed scents, asking them to select all they would consider purchasing.

Now, if you were to just look at purchase intent scores, you could find that Cherry blossom, Warm vanilla almond, and Floral lavender came out on top:

But if you chose those three scents, you’d be missing out on a big opportunity to expand your reach.

Why?

It could turn out that people who chose Warm vanilla almond also liked your existing Vanilla Bean scent. Eucalyptus and Floral lavender were also selected by many of the same respondents.

So instead of expanding your market, you would likely just cannibalize the sales of your most popular products- had you selected the three original winners.

But a TURF analysis could tell you a very different story.

While adding the Cherry blossom, Warm vanilla almond, and Floral lavender scents to your current lineup would appeal to 81% of the consumers you surveyed, it turns out there is a better combination for optimal reach.

In fact, by instead adding the Cherry blossom, Floral lavender, and Coconut scents to your inventory, your appeal score rises to 85%- greatly expanding the reach of your hand soap portfolio.

When Can I Use a TURF Analysis?

When it comes to applying TURF analysis to your research, the possibilities are (nearly) endless.

For marketers, TURF analysis will give you insights into the combination of message points that will appeal to the greatest number of people. Similarly, you can use it to understand which channels would work best for reaching new or larger audiences.

In product development, TURF analysis enables you to pick the perfect mix of product features that will attract the most potential customers.

And if you’re a consumer goods brand that deals with product flavors, colors, or other variations- TURF analysis can help you understand the market appeal to expect when launching something new. It will also tell you whether your newest product will encroach on the market of any of your existing offerings.

Automated TURF Analysis with SightX

We’ve made TURF analysis more intuitive than ever before with our latest feature drop!

Whether you're testing new products, features, or messaging- it's now easier than ever to experiment with different scenarios and identify a winning combination to expand your reach.

First, create a survey in SightX that includes the question that will be the base of your TURF analysis. This should be a multiple choice question, with the option for multiple selections turned on.

After you’ve collected responses, head over to the simulators page in the project's analysis section and choose one of the multi-select questions you included in your project. The applicable questions will auto-populate in the dropdown menu that appears:

Once you choose a question, the simulator will populate based on the combinations with the highest reach, considering all of the options in the question. In our case, we want to see the optimal combinations that include our five current scents. To do this, click into the dropdown labeled "Always include" on the right side of the screen and select the existing options that should be included in all combinations. Then, click "Recalculate".

Next, we'll use the Optimal Combination simulator to choose the number of options we want to see the optimal combinations for. We can see that with our five current scent options, only 60% of participants would purchase at least one of those scents. If we add one more scent to our portfolio, we can expect to increase our reach to appeal to 85% of participants. By adding two we would appeal to 81% of respondents, and by adding three (for a total of eight) we would appeal to 85% of the study participants.

We have the budget to add three new scents, so we'll click on the box for "8 options" so that we can see the optimal combinations.

We have the budget to add three new scents, so we'll click on the box for "8 options" so that we can see the optimal combinations.

Here, we can see the top five combinations with the highest reach. Two of these achieve 85% reach, while the remaining three achieve only 84% reach.

Of the tied top two combinations, both add Cherry blossom and Floral lavender to the existing portfolio of five scents. Combination one also includes Peaches & cream, while combination two includes Coconut instead. By choosing either of these top two combinations, we would increase our appeal from 60% with our five scents to 85% with eight scents.

If you want to dig in even further, you can review each combination on the graph below. Here, you can see the actual contributions of each scent. The visual shows the percentage increase in reach you would see by adding each additional scent to the combination. For example, we can see in all five combinations where we start with Cherry blossom (which appeals to 38% of respondents) and then add in Vanilla bean, we appeal to an additional 19%, and between these two scents we appeal to 57% of the respondents who participated.

But Vanilla bean wasn't selected by 19% of respondents - it was selected by 34%. However based on the results, 15% (34% - 19%) of respondents chose both Cherry blossom and Vanilla bean, so adding Vanilla bean as the second scent only appeals to an additional 19% of consumers. We call this the "incremental reach", while the 34% total appeal is called the "individual reach". You can see the individual reach by hovering over an area on the graph.

So, how might you decide between Combinations 1 and 2, when they have the same total market appeal of 85%? One way to do that is to look at the individual appeal of the options that make up each combination. If you hover over the options that differ between the top two combinations, you would see that Peaches & cream has an individual reach of 22%, while Coconut has an individual reach of 27%. This means that overall, Coconut appeals to more customers, and thus may be the best choice for the 8th scent to add.

-png-1.png?width=497&height=482&name=Untitled%20design%20(1)-png-1.png)

Another way to do this analysis is by looking at the frequency. The frequency shows the number of times each option was chosen by respondents, which shows the overall appeal of this option (instead of just the incremental appeal of adding that option to the combination).

In our example, we can see that Combination 2 has the highest frequency of the five top combinations shown.

Turn on the frequency line by clicking the icon in the legend, and see details by hovering over a point on the line.

Want to see the TURF simulator in action? If you have a SightX account, click here to open a sample project.

Getting Started with TURF Analysis

If you’re ready to level up your insights, we’ve got the tools to make it happen!

The SightX platform is the next generation of market research tools: a single unified solution for consumer engagement, understanding, advanced analysis, and reporting.

With the new addition of our TURF Analysis Simulator we have made it easier than ever to get insights on the products, features, and message points that will expand your reach.

Whether you are ready for a total DIY experience or prefer a little more support and guidance- we’ve got you covered. Reach out today to get started!